Understanding Loan Officer Hours at Minnco Credit Union: What You Need to Know

Introduction

Whenever an individual looks for a loan, he or she must know when the loan officers are available to provide timely help and ensure hassle-free application submission. Loan Officer Hours at Minnco Credit Union is one such reliable financial institution that comes up with varied types of Loan Officer Hours at Minnco Credit Union options and products. This article is designed to present information on the availability hours and time of loan officers so that you can connect with them whenever you need them at your convenience.

Loan Officer Availability at Minnco Credit Union

Loan Officer Hours at Minnco Credit Union aims to make it very accessible to its loan officers. While the exact hours vary depending on the location and the branch, here is the general outline of their availability:

Weekday Hours:

Typically open from early morning to late evening on weekdays.

Some branches may offer extended hours for added convenience.

Weekend Hours:

Many branches are open on Saturdays, with limited hours on Sundays.

Holiday Hours:

Loan officer availability may be reduced during holidays. Please check with your local branch for specific hours.

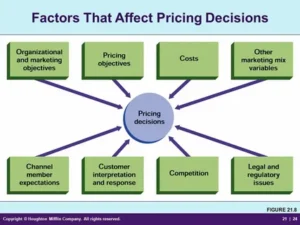

Factors Affecting Loan Officer Availability

Several factors can influence the availability of loan officers at Minnco Credit Union:

Factors Affecting Loan Officer Availability

Different factors can influence when loan officers are available at Minnco Credit Union:

Branch Location: Loan officers at different locations may have to operate at different times. The operating hours may be far apart in high-demand areas, such as city centers and urban areas that have a lot of demand from customers.

Seasonality: Sometimes, during particular periods in the year, more people will call for loan services before tax season or when borrowing is at its peak. This results in increased waiting periods for the loan officers and thus more waiting periods. Example: Holidays-Two weeks before Christmas is the rush as people will borrow money to buy gifts or pay for their traveling expenses.

Special Events: and promotions can further affect availability, as may be the case for special events or promotions that Minnco Credit Union may be conducting and contributing to. Some possible activities can include financial education seminars or loan fairs, where loan officers can be required to participate. With regard to regular appointments, loan officers may not be available, as a branch of the credit union may be holding special events and would therefore have a limited number of staff to serve the inquiries on loans.

Loan Officer Turnover: Loan officer turnover can also have an impact on availability. The time it may take to put in a new loan officer and train new people may then create a shortage of workers and therefore fewer loan slots available for appointments.

System Outages or Technical Malfunctions: Technical issues or system failures can hamper the functionality of loan officers and reduce their ability to service the consumers. For example, if the credit union computer systems collapse, a loan officer will not be able to process applications or collect access information from customers.

Economic Conditions: Economic conditions can influence loan officers. Loan services can be of great use during economic downfall or recession as all people attempt to understand the problem of proper money management. This increased demand could be a pressure in the direction of waiting times to see them.

Tips for Scheduling an Appointment with a Loan Officer

Advance Tips for You to Meet Your Loan Officer at Your Own Time:

Online appointments: Almost every Minnco Credit Union has an online appointment slot where you can choose a time and date that suits you best.

Phone appointments: In case online scheduling is not available for you, you may call your credit union branch to make an appointment with a loan officer.

Walk-in appointments: Walking in is also possible. However, if you can schedule in advance, this can save you a good deal of waiting around.

Loan Officer Services at Minnco Credit Union

Minnco Credit Union has loans to fit many needs in lending services.

Personal Loans: For loans to meet any personal needs, such as debt consolidation, home improvements, or a vacation.

Auto Loans: To finance new or used vehicles.

- Mortgage Loans: For purchasing or refinancing homes.

- Home Equity Loans: To access equity in your home.

- Business Loans: To support small businesses and entrepreneurs.

FAQs

Can I speak with a loan officer after business hours?

While loan officers may not be available for in-person appointments after business hours, you can often contact them by phone or email for inquiries.

What should I bring to my loan officer appointment?

Be prepared to provide documentation such as proof of income, identification, and any other required documents.

Can I apply for a loan online?

Yes, many Minnco Credit Union branches offer online loan applications, making it convenient to start the process from home.

How long does it typically take to get a loan approval?

Loan approval times can vary depending on the type of loan, the complexity of your application, and the required documentation.

Can I refinance my existing loan with Minnco Credit Union?

Yes, Minnco Credit Union offers refinancing options for various types of loans.

Conclusion

Knowing when it is the best time to visit Loan Officer Hours at Minnco Credit Union can make the process of seeking a loan very easy and less time-consuming. Ensuring enough time to book an appointment either online or by phone and coming to present all the documents and information needed places a better chance to connect with loan officers at the most convenient time for your schedule. A wide array of loan products and services with tremendous commitment to delivering top-notch customer service to you in helping you achieve your financial goals is what Loan Officer Hours at Minnco Credit Union.