fintechzoom.com Nikkei 225 Today: Latest Stock Trends

Introduction

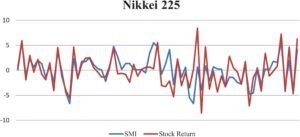

Special interest to global investors is the Nikkei 225 that assesses the performance of the largest firms quoted on TSE. Today the index, specifically the Nikkei 225, has faced a lot of volatility because of several factors within the global economy and geopolitical environment. In this article, the author is going to discuss current trends of stocks, main factors influencing stock movement, and potential expectations in the near future.

If you are interested in live update of Nikkei 225 or other financial trading markets, you can visit fintechzoom.com Nikkei 225 Today official website listing stock, crypto currencies as well as the financial technology.

Overview of the Nikkei 225: A Snapshot of Japan’s Economy

fintechzoom.com Nikkei 225 Today is a leading stock market index, which tracks 225 large companies of Japan across various sectors that includes technology, automobile and financial sectors. Many people consider it as an indicator of the overall Japanese economic situation and use it to analyze the results of some of the global primary companies including Toyota, Sony, and SoftBank.

Latest Trends in the Nikkei 225 (As of Today):

- Nikkei 225 Closing Value: [Insert today’s index value]

- Daily Performance: [Up/down percentage]

- Key Movers: Highlight top performers and laggards in today’s market.

Current developments show that the outlook for growth is cyclical and that investors operate on fluctuations in global statistics, inflation rates and currency.

Key Factors Influencing the Nikkei 225 Today

A. Global Inflation and Central Bank Policies

International inflation remains an important factor in the determination of stock markets and the fintechzoom.com Nikkei 225 Today. Currently the Bank of Japan (BoJ) still operates an ultra-loose monetary policy different from the recent tightening policies of US or European counterparts, and therefore the fluctuations of currency values, especially the fall of yen to dollar are attracting attention among the investors.

- Impact on Exports: A weaker yen is generally positive for export-heavy companies, which make up a large portion of the Nikkei 225, as it boosts their overseas earnings. Companies like Sony and Toyota have benefited from this trend.

- Inflation Concerns: Rising inflation globally, however, has made investors cautious. The BoJ’s response will be closely watched as inflation pressures build, affecting investor confidence in the Nikkei 225.

B. U.S. and Chinese Market Influence

The Japanese economy heavily depends on the largest partners of the global economy; the United States and China. Anything new happening around these areas, for instance China gradually slowing economically and the Federal Reserve raising interest rates has in one way or the other affected the Nikkei 225.

- U.S. Federal Reserve’s Interest Rate Policy: Any sign of further astronomic move by the Fed reactions in the US may lead to increased movements in the Japanese market due to the likely effect of high US interest rates which increase the dollar value while at the same time reducing the yen value.

- Chinese Economic Slowdown: Because China continues to experience slower economic growth, its imports from Japan could be affected, which causes volatility for Japanese companies.

C. Corporate Earnings Reports

The other source of activities in the Nikkei 225 index is the corporate earnings season also referred to as the Earnings cycle. This week, Japanese leading firms; Hitachi, Mitsubishi, and Panasonic are expected to release their scores for their quarterly earnings announcement and the traders are eager to take any negative signals before or positive signals after.

- Earnings Forecasts: This behavior is themed on the capability of positive earnings surprises to lift the index, while the possibility of negative surprises pulling down the index is also provided.

Top Performers and Laggards in the Nikkei 225

In today’s trading session, Top performers include major players in the technology and automotive industries. Here’s a breakdown of some of the top gainers and laggards on the Nikkei 225:

Top Gainers:

- Sony Group Corp. (6758.T) – Benefiting from strong demand for its gaming and entertainment products, Sony has seen its stock rise in today’s trading.

- SoftBank Group Corp. (9984.T) – SoftBank’s shares gained after positive news regarding its investment portfolio, including high growth in AI and tech sectors.

Top Laggards:

- Toshiba Corp. (6502.T) – Toshiba’s shares have dropped following uncertainties around its restructuring plans and corporate governance issues.

- Mitsubishi Motors Corp. (7211.T) – Mitsubishi saw its stock decline due to concerns about supply chain disruptions impacting production.

What to Expect for the Nikkei 225 in the Near Future

A. BoJ’s Policy Adjustments

Market is closely observing the actions of the Bank of Japan for further changes in the policy. The BoJ has claimed that they will continue to keep their interest rate low but changes in global inflation and currencies might change this. Any changes could likely result in major shifts most especially for those companies in this index that may be enjoying export link growth.

B. Global Economic Recovery

Another would be the speed of the global economic rebound from COVID-19 disease would also come into play. The Nikkei 225 can keep on increasing if other large economies remain on the path to recovery and there is an uptick in demand for Japanese products. Nonetheless, contingent factors for example, energy crisis and geopolitical conflicts may be risks.

C. Technological Innovation

Today some of Japan’s technology giants like Sony and Panasonic are deeply invested in the sectors like Artificial Intelligence Automobile or Renewable Energy. Progress made in such fields could help to drive up the Nikkei 225 especially as the world turns to technology solutions.

How to Stay Updated on Nikkei 225 Trends

Catch the latest information and discussions on the Nikkei 225 on fintechzoom.com now. It includes coverage of stock market indicators, daily and hourly quotations, and the views of the market and financial analysts who advise investors.

Additional Resources:

- Real-Time Market Data: Follow the latest movements in the Nikkei 225 with live updates and data feeds.

- Expert Analysis: Access in-depth analysis from financial experts on fintechzoom.com to better understand market drivers and trends.

- Financial Tools: Utilize a range of financial calculators and tools available on fintechzoom.com to plan your investment strategy effectively.

FAQs

What is the fintechzoom.com Nikkei 225 Today?

The fintechzoom.com Nikkei 225 Today market index is a Tokyo Stock Exchange that includes 225 large public stocks in Japan. It is often regarded as a bellwether of the general performance of Japan’s economy; it indicates the stock price movements of Sony, Toyota, and SoftBank.

What factors influence the Nikkei 225’s performance?

Several factors can impact the performance of the Nikkei 225, including:

- Global economic conditions (inflation, interest rates)

- Exchange rates, especially the value of the yen against other currencies

- Corporate earnings from key companies in the index

- Geopolitical events affecting Japan’s trade relationships

- Central Bank policies like those of the Bank of Japan (BoJ)

How does the weakening yen affect the Nikkei 225?

A weakening yen typically favors businesses whose revenues come from exports in the Nikkei 225 because the former makes the output less costly for overseas consumers. Companies could therefore realize increased profits from overseas sales, increasing the average index. Conversely, a weak yen can also escalate the cost of imports, making some industries less profitable.

How can I stay updated on the latest trends in the Nikkei 225?

Visit fintechzoom.com, among others, for live news concerning Nikkei 225 and other equity markets with actual data besides expert analysis and in-depth articles about current equity market trends. This also includes financial news and tools that help investors to track their portfolios.

What are some top companies in the Nikkei 225 index?

Some of the largest and most influential companies in the Nikkei 225 include:

- Toyota Motor Corp. (Automotive)

- Sony Group Corp. (Technology and entertainment)

- SoftBank Group Corp. (Telecommunications and technology)

- Panasonic Corp. (Electronics) These companies play a major role in driving the performance of the index, and their stock movements are closely watched by investors worldwide.

Conclusion

However, the fintechzoom.com Nikkei 225 Today is still relevant for gauging the effects of the Japanese economy on the world and the major concern of foreign investors called fintechzoom.com. Current trends in stock indicate how multinationals and firms’ performance work hand in hand with central banks. These and other platforms such as fintechzoom.com would help investors manage the Nikkei 225 well, frequent updates of the latter being highly beneficial.

Both those who have been in trading shares and other securities for some time now, and those who are starting this journey for the first time will need to be careful about some factors and trends in order to make the right investment decisions in the coming months.