Understanding Bastiat Restraint of Trade: A Closer Look

Introduction

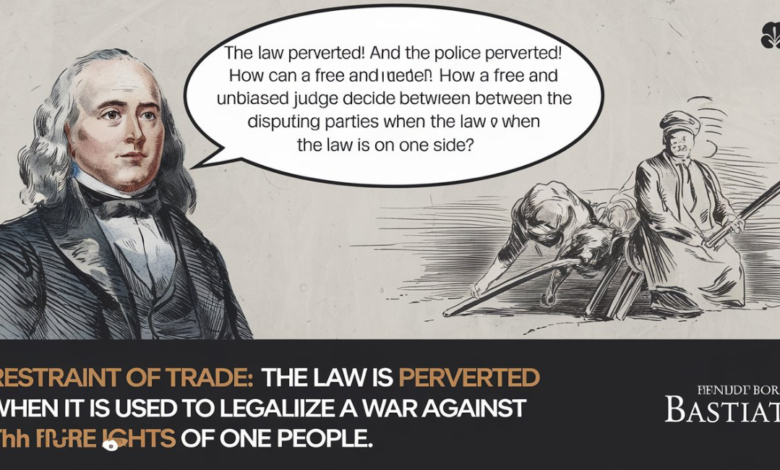

Bastiat Restraint of Trade concept of restraint of trade explores how regulations impact economic freedom. By analyzing these constraints, we gain insight into their effects on market dynamics. This idea is crucial for understanding the balance between regulation and economic liberty.

Ever wondered how trade restrictions shape the market? Bastiat restraint of trade theory offers a fascinating perspective.

Bastiat restraint of trade examines the effects of government-imposed limitations on economic activities. He argues that such restrictions often harm both consumers and producers by distorting natural market forces. Understanding this concept helps in evaluating the true cost of trade regulations.

The Core Concept of Bastiat Theory

Essentially, Bastiat’s restraint of trade can be defined as the concept that several laws hurt the overall business instead of benefiting it. He notes that when this happens then it means that traders are limited in the market against both the buyers and sellers side. This perspective seems to reason that free trade is normally characterized by improvement of position by all the parties involved.

Historical Context of Bastiat Economic Views

Frederic Bastiat was an economist writing in the nineteenth century whose work to a large extent was in opposing protectionism and interference in the market economy. It is important to understand that his concerns about restraint of trade were expressed at a time of great economic change. Familiarity with this context assists in finding relevance of his ideas to the current society.

The Impact of Trade Restrictions on Consumers

Bastiat also observed that protectionism and tariffs result in higher prices and a lesser variety of products that are [available to the public. Any regulation that closes down competition also means a small choice for consumers besides high charges. This consequence shows why a free and open market should be maintained at all costs.

Effects on Producers and Market Efficiency

Bastiat highlighted that producers also suffer under restrictive trade policies. These constraints can limit their market access and reduce their ability to compete. By curbing market efficiency, trade restrictions can hinder economic growth and innovation.

Reduced Market Access: Some of the impacts include; The trade barriers can hamper the producer’s expansion into other markets or areas, thus shrinking its potential market.

Increased Costs: Therefore, regulations and tariffs may raise the production costs and since these costs are recoverable either from the consumers or by reducing the profits of the producers.

Decreased Competition: Since the free trade will limit the production and importation of the products, producers are likely to lax and hence deplete on innovation in industries.

Lower Productivity: They result in inefficiency through discouraging efficient producers from exercising their efficiency by allowing the less efficient ones into the market, this reduces general productivity.

Limited Resource Allocation: They give a wrong signal in resource mobilization since they trap resources in less efficient uses as compared to the free market.

Modern Implications of Bastiat Ideas

The currents and prevalences of restraint of trade theory of Bastiat also counts in the present world economy. Current) discussions on trade liberalization and other policies and acts are not far from such thoughts of his. To understand the effects of current trade barriers in light of Bastiat’s intervention, they are presented in this paper.

Pros and Cons of Trade Restrictions

|

Pros |

Cons |

| Protects Domestic Industries | Raises Costs for Consumers |

| Trade restrictions can shield emerging or struggling local industries from foreign competition, allowing them time to develop. | Restrictions can lead to higher prices for goods and services as domestic producers face less competition. |

| Promotes National Security | Reduces Market Efficiency |

| Ensures that key industries crucial for national security are not overly dependent on foreign suppliers. | Trade barriers can prevent markets from operating efficiently, leading to suboptimal resource allocation. |

| Encourages Local Employment | Hinders Innovation |

| Protecting domestic industries can lead to job creation and economic stability within the country. | Reduced competition can lead to less incentive for firms to innovate and improve their products or services. |

| Boosts Domestic Production | Restricts Consumer Choice |

| By limiting foreign competition, trade restrictions can encourage local production and business growth. | Consumers may face fewer choices and limited product variety as a result of protectionist policies. |

| Supports Strategic Industries | May Lead to Retaliation |

| Helps support industries deemed vital for national interests or strategic goals. | Other countries may retaliate with their own trade restrictions, leading to potential trade wars and economic tensions. |

FAQs

What is Bastiat’s restraint of trade?

It’s a theory that government trade restrictions harm economic freedom and market efficiency.

Why did Bastiat criticize trade regulations?

He believed they distorted market forces and harmed both consumers and producers.

How do trade restrictions affect consumers?

They lead to higher prices and fewer choices in the market.

What impact do restrictions have on producers?

They limit market access and reduce competitive opportunities.

Are Bastiat ideas still relevant today?

Yes, his critique of trade restrictions is still pertinent in modern economic discussions.

Conclusion

The restraint of trade theory as given by Bastiat Restraint of Trade allows one to understand the negative influence of economic regulations. It does so while focusing on the adverse impact free trade may have on both the consumers and the producers which in turn helps to stress the fact of free trade. Most of his ideas are still felt in today’s economic discussions, thus the importance of good trade relations. It is beneficial to comprehend his perspective in order to assess the actual price of regulation burdens.

Эта компания помогает увеличить видеопросмотры и аудиторию в Twitch. Благодаря нашим услугам ваш стрим станет популярнее и привлечет новых зрителей. Боты на Твич накрутка зрителей Мы гарантируем качественные просмотры и активных пользователей, что повысит рейтинги трансляции. Быстрая работа и доступные тарифы позволяют развивать канал без лишних затрат. Простое оформление заказа не требует сложных действий. Запустите раскрутку уже прямо сейчас и выведите свой Twitch-канал в топ!